EURUSD – Weekly Outlook for 21st May 2021

EURUSD Forecast for Forex

Introduction

The currency market on the IQ Option forex platform for this trading week will have a lot of anxiety as traders, investors and other participants await the U.S central bank to release the minutes of its April policy meeting on Wednesday.

We expect it to influence the direction of the US economy based on monetary policy.

EURO and US News

German Flash Manufacturing PMI

Based on the purchasing managers survey in the manufacturing industry, they carried a level of diffusion three weeks into the recent month. The outcome has quick feedback on the market’s sentiment as a leading indicator for the traders and investors. The purchasing managers have relevant insight into companies’ views regarding the economy.

There is an industrial expansion if the reading is above the 50.0 levels. It becomes a contraction if it is below the 50.0 level. The previous data was 66.2 while the forecast is 66.0.

Existing Homes Sales

Despite the economy stumble amid the COVID-19 pandemic, the housing sales have been like dancing stage as buyers are moving to the suburbs as social distancing has fueled the need for customers to have an office space at home, this as put the sector on an impressive trajectory.

The sales of homes have a ripple effect in the market and it is measurement is annual. They only put the total numbers of residential buildings that were sold in the previous month excluding recent constructions into consideration.

An actual outcome greater than the forecast is good for the U.S dollar while a lower result is not good for the currency. Forecast data is 6.09M, while the Previous is 6.10M.

There’s a high demand for homes and the authorities permit it, but the building construction is delayed because of shortages in the building materials. There are outrageous demands colliding with scarcity of supply which is sending the prices of materials higher in the marketplace.

Existing Homes Sales

Despite the economic stumble amid the COVID-19 pandemic, the housing sales have been like a dancing stage as buyers are moving to the suburbs as social distancing has fueled the need for customers to have an office space at home, this as put the sector on an impressive trajectory.

The sales of homes have a ripple effect in the market and it is measurement is annual. They only put the total numbers of residential buildings that were sold in the previous month excluding recent constructions into consideration.

An actual outcome greater than the forecast is good for the U.S dollar while a lower result is not good for the currency. Forecast data is 6.09M, while the Previous is 6.10M.

There’s a high demand for homes and the authorities permit it, but the building construction is delayed because of shortages in the building materials. There are outrageous demands colliding with the scarcity of supply which is sending the prices of materials higher in the marketplace.

EURUSD Technical Analysis

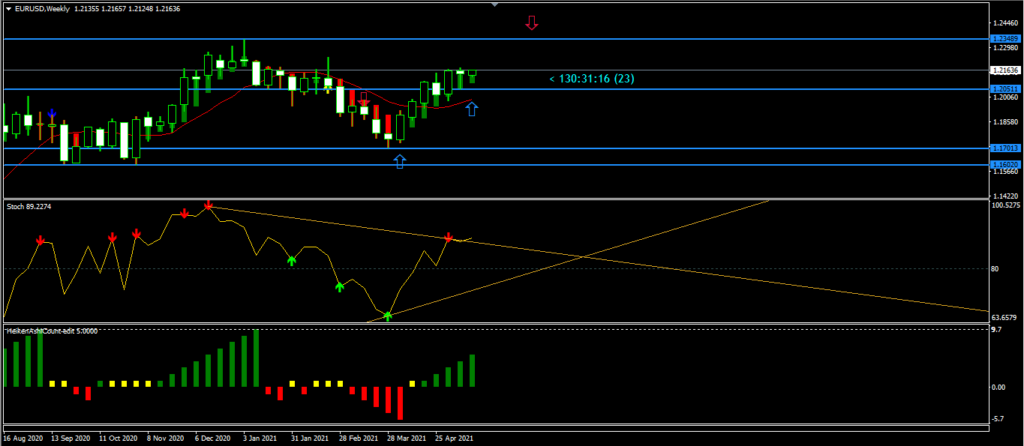

Weekly Chart Bullish Swing

Weekly Resistance Level: 1.23462

Weekly Support Level: 1.16770, 1.13970, 1.06263

The EURUSD pair has been bullish for the past four weeks because of the general weakness in the U.S dollar has the economy is facing a high level of inflation in the U.S economy.

This week on the forex platform we expect traders, investors to be skeptical about the outcome of Federal Reserve meeting.

The outcome may lead to the breakout of the resistance level of 1.23462 for a bullish run. The reading of the meeting could bring about a reversal of the trend from the resistance zone if the interest rate decision would be favorable to the U.S dollar and will strengthen the economy.

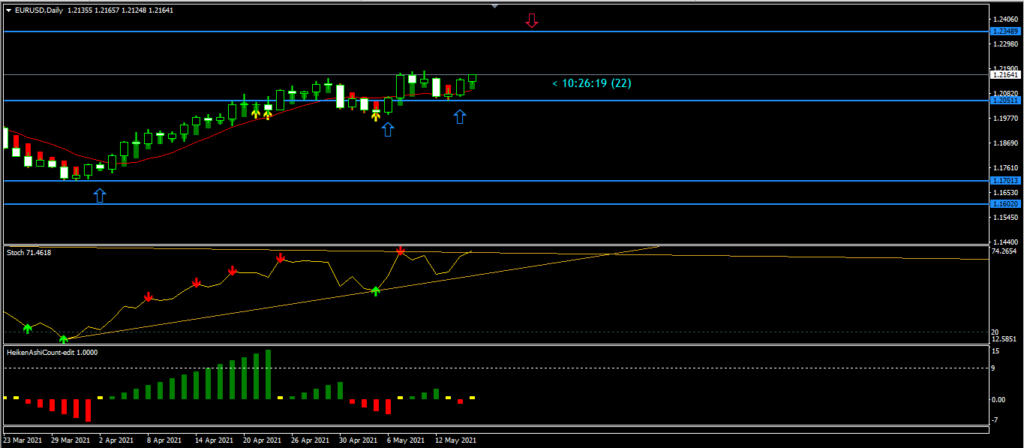

EURUSD Daily Chart Projections: Bullish,

Daily Resistance Level 1.23489

Daily Support Levels 1.20511

In some part of Europe, the progress made on the COVID-19 vaccination and easing restrictions of movement and social gathering to contain the pandemic infection has lifted high-risk currencies that stand to benefit most from an economic revival in this quarter.

We expect the beginning of the week to be bullish as we can see that it formed a double bottom pattern on the support level of 1.20511 showing a bullish swing to the upside on the forex platform.

We expect the policymakers in the United States to reiterate their intentions to stay on course and leave key interest rates near zero for the foreseeable future which will allow the dollar to float in the direction they choose.

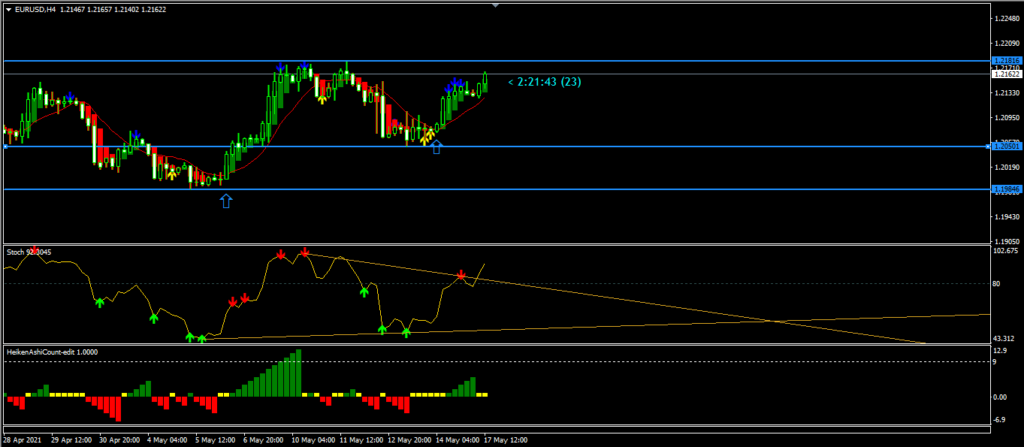

EURUSD: H4 Intraday Chart Overview,

Four Hour Resistance Level 1.21816

Four Hour Support Level 1.20501

The recent swing on the H4 chart shows that there is a bullish momentum in the market as the price approaches the resistance zone with a strong bullish candlestick. The Stochastic indicator shows a bullish trend on the chart and we expect it to last for some time.

The price of EURUSD is around the 1.21816 level and there is a higher probability of price closing above it in some hours to come.

Conclusion and Weekly Price Objectives

The EURUSD pair will be bullish at the beginning of the trading week before the Fed policymakers meeting will either change the direction of the pair or it will continue its bullish trend for the week.

No Comments found