CFD Multipliers explained

A lot of people trade in cryptocurrenciestocut tensions through the crypto currency trade, however, there is another possibility that can trigger price movements. It can be accomplished by using a Difference Contract (CFD). If we have to understand the potential of the CFD tools involvedin cryptocurrencies, one has to to analyze CFD.CFDs are also called financial derivatives that are executed as agreements orcontracts in between a trader with an intermediary company. When a contract exists, we, in actuality do not possess ownership of the fixed asset, but we have the rights to obtain the difference in between the present value of the real estate and the value which will be calculated in the future. If the forecasts of the worth of a fixed asset are incorrect along with the difference which is negative, it is incumbent on the trader to cover up this loss. There are many people involved in bitcoin CFD.

A lot of people trade in cryptocurrenciestocut tensions through the crypto currency trade, however, there is another possibility that can trigger price movements. It can be accomplished by using a Difference Contract (CFD). If we have to understand the potential of the CFD tools involvedin cryptocurrencies, one has to to analyze CFD.CFDs are also called financial derivatives that are executed as agreements orcontracts in between a trader with an intermediary company. When a contract exists, we, in actuality do not possess ownership of the fixed asset, but we have the rights to obtain the difference in between the present value of the real estate and the value which will be calculated in the future. If the forecasts of the worth of a fixed asset are incorrect along with the difference which is negative, it is incumbent on the trader to cover up this loss. There are many people involved in bitcoin CFD.

What is leverage?

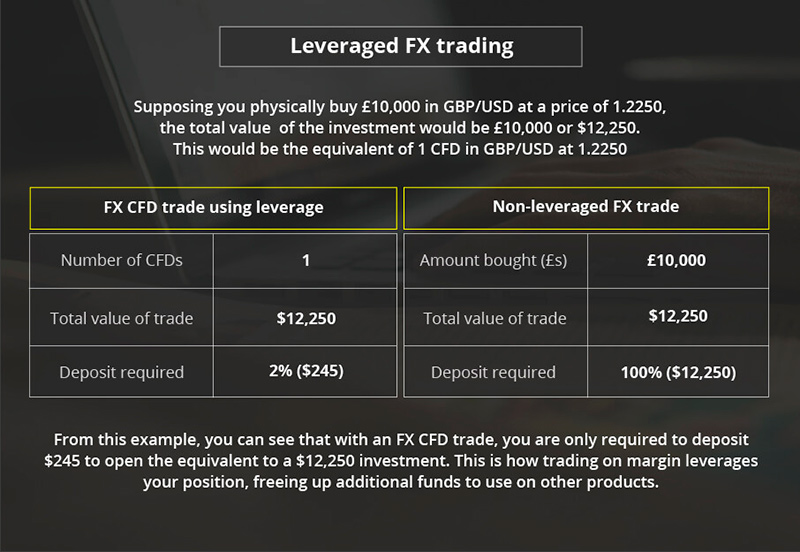

Leverage can be defined as a tool which is used to negotiate with much more actual capital than what the trader possesses. In practice, this means that when a cryptocurrency position opens an investment of $ 500, and a lever of 5: 1 is used, not traded with $ 500, instead, you trade with fivemultiples of theamounts of capital; in this case it is $ 2,500. Due to this, you stand to earn even if there are small movements in price.This being said, you can lose a lot of money as well if there are any price movements in the opposite direction and this can significantly damage your funds. Hence, you must carefully consider whether leverage negotiation is appropriate for your style of negotiation. Almost all CFD brokers offer leverage. All brokers regulated by European CySEC regulator should have a maximum leverage for cryptocurrency 5 is to 1. Almost all exchanges will not support any operations sell out of different Kraken, Bitmex, as well as Poloniex, where the trading in leveraging would only be used with certain pairs of cryptocurrencies.

Volatility of crypto market

The cryptocurrency market can increase or decrease by 10% in a few minutes or hours. It is completely different from the classic or equity stock markets and it is important to realize that investing in cryptovalue puts high risk capital. The cryptography market is probably the most welcoming, even for beginners. However, you should still understand that the great experience of cryptocurrencies in price peaks regularly does not always bring the desired benefits. In fact, they can also have a devastating effect on investor capital. Now, I will show you how to significantly reduce the risk. However, you should always be aware of the volatility of the crypts. There are courses held to teach beginners the basics of CFD trading.

Bitcoin in CFD

If you’re interested in Bitcoin futures, set the price you desire to sell or purchase a certain amount of bitcoins at some moment later. Because you do not needto purchase immediately, you too are taking advantage of your stance by having the exposure to assets while publishing a guarantee, or minor percentages of the cost, hence, with a 10 to 1 leverage you will be exposing ten Bitcoins in your place. By one, but you are also exposed to towards potential losses, leverage happens to be a dangerous but also potentially rewarding game. Considering options, there are more intricate sets of tools and alsoterms: there will be calls, and both have a long position and a short standpoint.In case you buy calls, they will last a long time and in case of you selling a call it is said to be small or short, and for selling options you buy put options and you cut it if you sell it.Bitcoin purchase optionswill give you exposure to any rising prices within the principal or primary above a certain price, you can call it a strike price, the longer call will earn cash if the cost of the bitcoin which has to be paid by the shorter position in the call of the Bitcoin. Cryptocurrency CFD’s are rapidly gaining popularity over the course of time.

CFD Trading

In the case of CFD transactions, the basic asset cannot be acquired or traded (for example, 1 fiscal security, a pair goes to donate currencies or a commodity). Purchase or sell a number of Units for a particular instrument, depending upon if you think that the costs will rise or fall. There are offer CFDs in a wide variety of international markets. Our CFD instruments include stocks, Tresor Coupons, Vaig Donate Currencies, Commodity Indices, Menja and FTSE 100, which aggregate the price movements listed in FTSE 100. For each punt when the cost of instrument moves to your account, Multiplier earnings of the amount of CFD aggregate Units that you bought or sold. For each punt where the price moves contrary to your expectations, you stand to make 1 Loss. Remember that your losses may sometimes surpass your deposits when you are into bitcoin CFD or CFD trading.

Short term v/s long term betting

CFD transactions are generally considered to be a much better choice for daily trading cryptocurrencies as spreads tend to be lower. However, there is usually an exchange rate that intermediaries apply when traders remain in one position overnight. For this reason, most of the CFD brokers are unsuitable for any long term investments and maintenance. Cryptocurrency exchanges do not trade or snap, so long-term investment is an ideal option here. You could buy cryptocurrency and keep it for as long as you like, and then sell it for flat money, or exchange it with other cryptocurrencies. The higher spreadisdenied by a considerable increase in the value like in bitcoin CFD.

Spread betting

Spread betting is defined as tax-exempted financial derivatives that permit your speculation on the movement of prices of a financial market, without you actually possess the underlying asset. Instead, you need to try and predict if the prices of the market will increase or decrease and the degree to which you are right or do not determine your profit or loss.The spread betting takes its name from the spread, or the two prices that always adapt to the price of the underlying market. The costs of a particular transaction are taken into account in these two prices (known as supply and supply), so you will always buy a price slightly higher than the market price and sell it slightly below. If you are genuinely interested in cryptocurrency CFD’s, then you would do well to read up and research the topic because it requires a degree of expertise to come out on top of the market. There are many people out there who are seriously into cryptocurrency CFD’s and they have made quite a bundle at the end of the day. But at the same time you should be careful not to go overboard with investing because the market is very volatile.