BTCUSD Weekly Outlook and Bitcoin Fundamentals, 14th May 2021

BTCUSD Forecast and Fundamentals for Bitcoin

Introduction

The introductions of new crypto coins like DOGE coin, SHIB token into the crypto market is drawing the attention of Indian brokers, Elon Musk, and other investors into the bitcoin saga and other asset class.

BTCUSD Technical Analysis

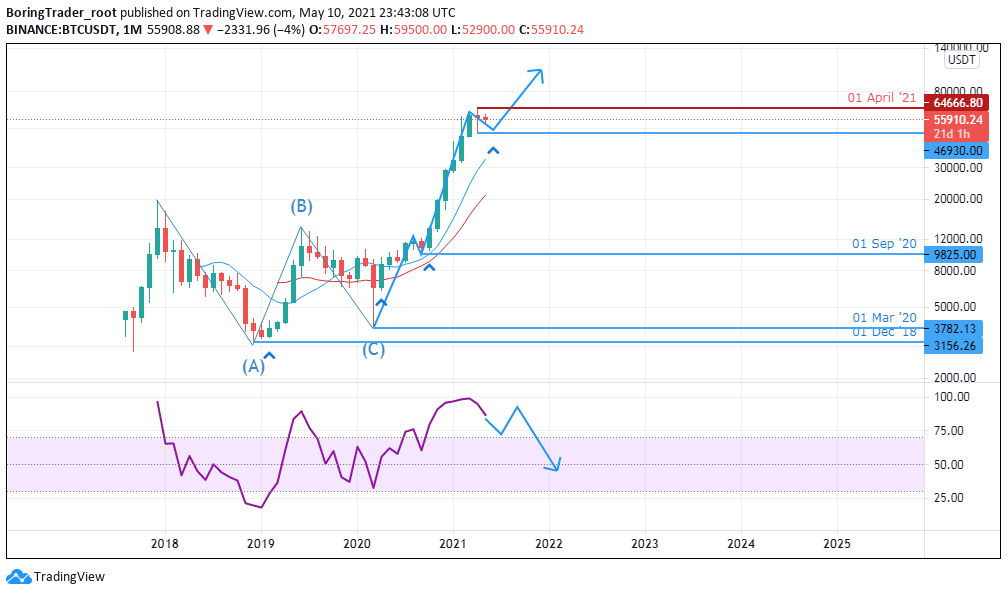

Monthly Chart

Monthly Resistance Levels: 64666.80

Monthly Support Levels: 46930.00

Has Bitcoin found a resistance level? This might be the question going on in the mind of the Indian brokers, as we can see that the previous month end with a doji candlestick. If the Bears can close below the support level of 46693.00 in the coming month, we shall see bitcoin having it correction phase on the monthly chart.

However, if Bear’s rally is not strong, we may see the Bulls close above the 64666.80 zones for another bullish run with will probably create a new all-time high in the history of bitcoin.

Weekly Chart

Weekly Resistance Levels: 64840.00

Weekly Support Levels: 46966.2, 29254.1

The BTCUSD has been a safe-haven for crypto investors as they saw an increase in their portfolio during the COVID-19 pandemic which affected other businesses in the fiat portfolios. A close below the 49666.2 level will attract sellers into the market for a push towards the 29254.1 level.

From the oscillator we can see that a continuation pattern to the upside is building up. If the indicator can find a support within the oversold zone, we may see the bulls take over the market from the area where price is.

Daily Chart

Daily Resistance Levels: 64899.00, 59000.00

Daily Support Levels: 50591.38, 47044.01

The daily chart shows that the Bears where able to rally the price of BTC down from the resistance level of 64899.00 and currently we are seeing a retest of the resistance zones by the bulls. A failure from the bulls to close above the level will attract more Indian brokers to take a short position from the zones targeting the 50591.38 levels.

There’s a recent bullish surge with a strong momentum to close above the resistance zone which will mean that the bullish trend is aiming for a new high on the time frame.

Bullish Scenario:

A possible bullish scenario is likely if the price can close above the resistance of 64899.00 on the daily time frame.

Bearish Scenario:

A Bearish flag pattern is built on the daily chart as we see price retest the resistance zones. If the bull’s momentum cannot close above the zone, we expect the sellers to opening short positions.

Bitcoin BTC News Events

Nasdaq Buys Bitcoin for Treasury

Nasdaq is a big tech company listed in the US stock exchange and widely known in the Latin America for its e-commerce size with her headquarters in Buenos Aires in Argentina.

Recently, the company filed Form 8-K with SEC (the U.S Securities and Exchange Commission) stating their net income before tax was up by $9.4 million from the loss of about $16.5 million during the Q1 of 2020. However, the first quarter of 2021 had bitcoin as part of its earnings report.

Mercado Libre also discloses the company’s plan in treasury. The company’s strategy is to purchase bitcoin worth of about $7.7 million for their indefinite lived intangible assets in this quarter.

For the company to reach out to her wide range of clientele, they updated their online marketplace in Argentina so that interested investors can go to a page within their real estate site to see which of the properties they can purchase using bitcoin.

The popular demand of BTC has made some Wall Street giants to offer bitcoin base investment for their clients.

The News from U.S Banks preparing to offer crypto custody and trading products to clients triggers the buying pressure of BTCUSD to rise above $56000 mark.

A subsidiary of NYDIG, Stone Ridge’s crypto custody (New Digital Investment Group) partnered with Fidelity National Information Services (FIS), a Florida based bank software provider to work together and provide US banks with required infrastructure to enable their clients buy, sell and hold bitcoin. This project is expected to go live in few months.

The possibility of buying and selling bitcoin directly from an individual’s bank account is a pointer that mainstream has finally embraced crypto-assets.

The BTCUSD gain popularity and other asset class because of the rate at which the value of the US dollar has diminished in the international trade market. The COVID-19 pandemic is also one of the major issues that added problems to government around the globe which led to the printing spree of money to aid citizens of various countries via different stimulus packages to revive the economy.

Conclusion and Projection

The BTCUSD found support around 50591.38 level after the sharp decline in price. BTC started a steady movement upwards towards the resistance levels of 59000.00. A close above the level will open the 64899.00 zones, however, the price will need a proper breakout above the zone for the bullish run to continue upwards.

If the price cannot close above the levels BTCUSD risk another fresh decline from the Bears from the resistance zone.

Fortune 500 companies have embraced the digital assets for investments. Some strong wall street critics of bitcoin and other digital assets like Goldman Sachs and JP Morgan have started to offer its clients bitcoin-based investment platforms because of their growing demands of the assets class.

No Comments found