Bitcoin to USD ( BTCUSD ) Weekly Outlook , August 1 2019

BTCUSD Forecast and Technical Analysis & Fundamentals for Crypto

Introduction

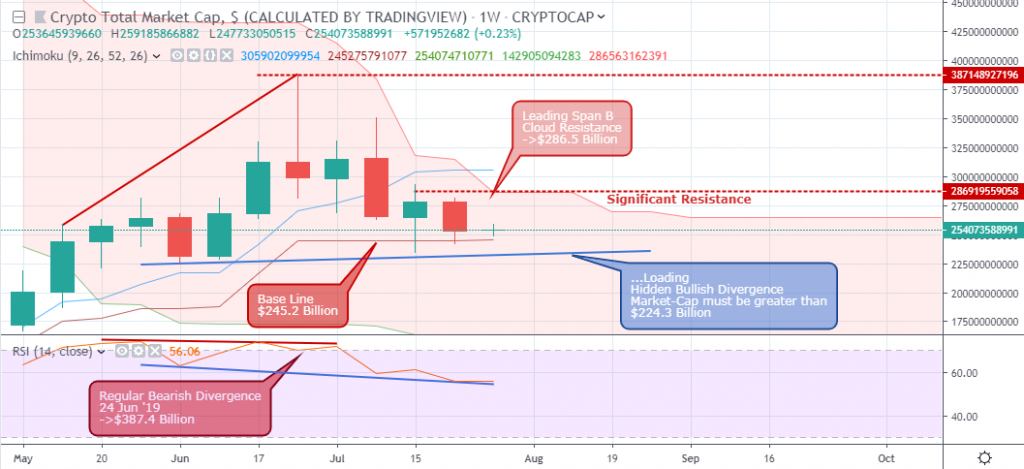

The Bitcoin BTC cryptocurrency makes up the highest percentage of the total crypto market-cap, as a result, a view at the total market-cap sheds some light into a general adoption of the market. Making reference to the weekly chart of the total market-cap, we notice that it rest on a support (base line) of about $245.2 Billion. A break above the significant resistance at $286.5 Billion will confirm a continuation of the markets’ bullish trend.

Let’s look at the general technical patterns driving the Bitcoin BTC price as well as interesting news announcements in the space.

BTCUSD Technical Analysis

BTC/USD Daily Chart

After the closing price of the right shoulder of the head and shoulder pattern, the BTCUSD plummets by about 14%.

So far, a price break above a previous day high is not yet signaled. A price close above the $9725.17 resistance is our signal to enter a long position. A break below the $9111.00 support will confirm an increase in selling pressure.

BTCUSD: 4Hour Chart

The Bitcoin BTC price close above a collection of resistance on July 28 ’19 emphasizing an increase in bullish pressure.

After forming a higher low on July 29 ’19 11:00, the BTC price went further to break above another bearish resistance ($9649.14) on July 30 ’19 19:00 confirming the bullish campaign.

From the breakout point, the expected price objective is the $10248.41 resistance; a level attained at press time

BTCUSD: 2Hour Chart

Following a breakdown of support and increase in sell pressure on July 27 ’19 03:00 ($10235.00), the Bitcoin price from an intraday level dips by about 9.2% before flagging a regular bullish divergence on July 28 ’19 17:00.

Although the BTC price generally on IQ Option platform retraced the earlier price surge by 3.7%, another break above resistance on July 29 ’19 15:00 confirmed the support at $9363.02.

Bitcoin Fundamentals

US Fed Rate Cuts Are Helping Bitcoin Fundstrat: Tom Lee

Co-founder of Fundstrat Global Advisors of Tom Lee believes that Bitcoin (BTC) is benefiting from the fresh slice of interest rate in by the US Federal Reserve.

In an interview with Fox Business on the 31st of July, Mr. Lee explained how the rate cuts affect BTC.

He revealed that with interest rate cuts adding liquidity, investors are being forced to push their money into such risk assets and hedges like Bitcoin, making BTC a macro hedge for investors and a form of insurance against any likely adverse occurrences.

In a far-ranging interview, Mr. Lee also revealed that he believes in the possibility of BTC hitting its $20,000 all-time high price before the year’s end.Conclusion and Projection

Although the BTCUSD at press time reflects bullish sentiment, a break below the Ichimoku Cloud baseline ($245.2 Billion) on the weekly chart of the total crypto market-cap however, will signal strong bearish sentiment and a general decline in the price of cryptocurrencies across the market.

On the other hand, a break above the Ichimoku Cloud Span B ($286.5 Billion) should confirm the bullish campaign anticipated to push the price into the monthly time frame of the BTCUSD overbought territory.

No Comments found